A recent rise in private-label product success is forcing national brands to compete for their share of the retail market. With low prices and high quality, private-label products have gained popularity and shed their negative stigma in the last decade.

Retailers, realizing that emerging technology is allowing consumers to shop smarter from store to store, aimed to shift previously brand-loyal consumers to become retailer-loyal. When stores created these cheaper private labels, consumers started to trust the consistency of the store brand.

Now, national brands are threatened by these store-brand competitors. Costco, Trader Joe’s, and Whole Foods are just a few of the major chains taking advantage of the opportunity and quickly gaining consumer trust of their brands. However, there are factors that play into what makes a private label successful and where name brands can keep their share of the market.

Depends on the item …

Certain products yield much higher name-brand loyalty than others. Fortunately, market researchers have done extensive research into this consumer behavior.

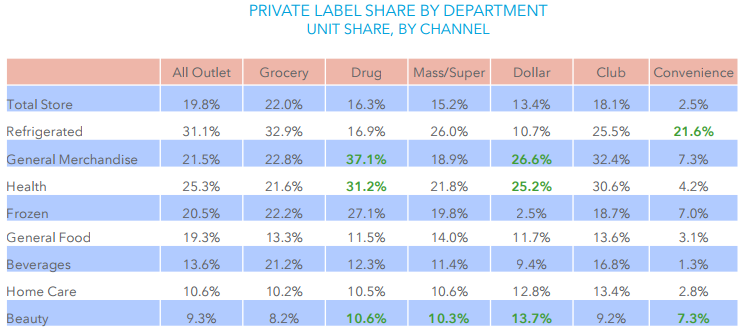

According to The NPD Group, the most popular private-label items are “ingredients,” such as flour or butter. Eggs, refrigerated meat, pre-made salads, snacks, and creamer also top the list. The general consensus of many studies is that dairy products, canned items, and snacks are the leading industries for private-label goods to succeed in.

Yet national brands do hold a strong market share in some categories. According to Mintel researcher Fiona O’Donnell, consumers strongly prefer name-brand personal-care products, vitamins, and drinks.

The rationale for name-brand preferences is attributed to channels that require constant innovation. Personal-care brands consistently come out with new products each season, and private labels cannot keep up. An example is the shampoo industry. While private labels can offer a general shampoo, many brands have specific “dandruff targeting” or “dye-safe” products that appeal to select consumers. This equally applies to the wide variety of specialty drinks that tend to follow trends, ranging from flavored cold brews to new yerba mate teas. The private-label companies simply cannot keep up in these industries.

Credit: https://www.foodinstitute.com/images/media/iri/TTJan2015.pdf

The strategies for name-brand success

This increased pressure on name brands means they need to strategize on how to maintain their market share. It is important to continuously convert new consumers and maintain the current buyers.

Be innovative!

The biggest advantage that name brands have, which also can be their biggest downfall, is the option of risk. Private labels take little risk with their products, as they typically choose not to market their items and need to maintain consistency. New innovative items can draw attention to name brands and create the potential to convert a future loyal customer.

Private labels are trying to combat the innovation of name brands by quickly copying the product. One manufacturer, Treehouse Goods, told Food Industry that they aim to copy innovative new products as soon as they are released. Nonetheless, it takes time for these copycat manufacturers to do the research and development for their version. This gives name brands an edge to stand out on the retail shelves.

Market, market, sell!

Private labels do not typically use marketing or trade promotions. Considering 76 percent of purchasing decisions are made in store, drawing attention to name-brand products can significantly counteract the competitive low prices of private labels. When brand names combine marketing with new products, consumers cannot ignore them. Follow our tips on trade promotion to maximize this strategy!

Beyond the shelves, store brands will rarely advertise their products. Using the right online strategies may shift the consumer’s attitudes when they are in the store.

All in the label

Store brands typically have simpler labels that can be recognized across channels, and they are also cheaper to manufacture. While there is the strategy of recognition here, it is equally valuable to create a label that attracts consumer attention. Advertising the reasons why the name brand is better right on the label helps the 76 percent of in-store purchase decisions be made for the name brand.

Infiltrate the right locations

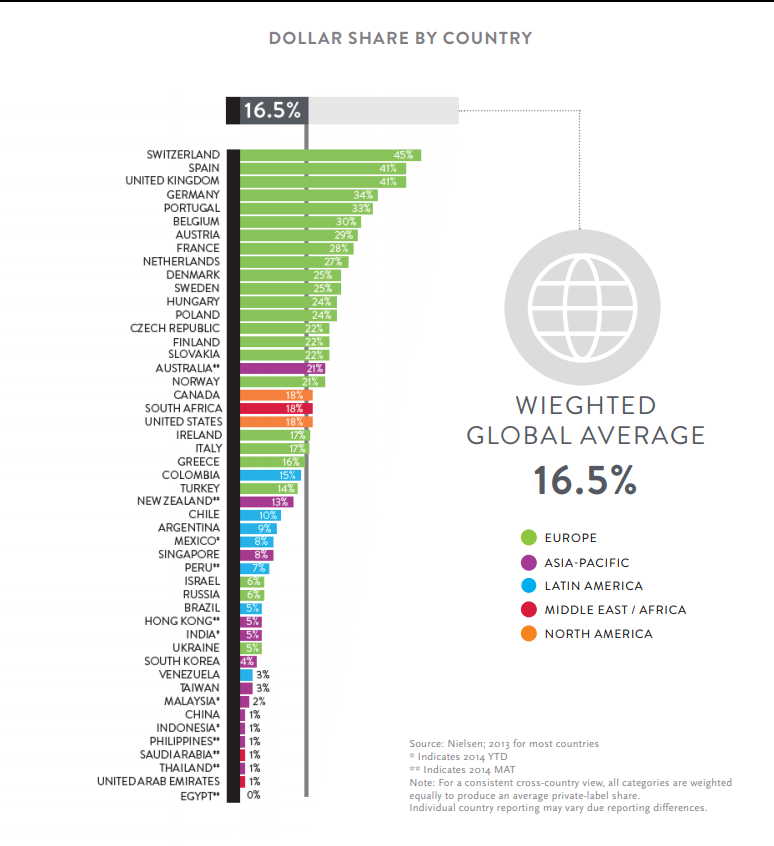

Private labels are steadily rising in certain channels and locations. Simple awareness of these areas can assist in the approach. For example, according to Nielsen, European countries’ private-label market is as high as 45 percent (in Switzerland), North America averages 18 percent, and the Middle East scrapes an average of 1–2 percent. However, the reasons for these differences vary from country to country. When addressing how to market or where to introduce new products, this information is extremely valuable.

The recent rise in the success of private labels in the United States is because of the economic climate in the past decade. After the economic downturn, many US consumers were forced to shop more conservatively by buying private-label products. Upon the realization that the products were minimally different than their more expensive name-brand counterparts, many people have continued to purchase these options. Knowing why the consumers are switching to private labels will assist in how to approach marketing to them.

It’s a constant challenge for these brands to capture and maintain consumer trust in the retail market. Name brands need to fight back with their powers of innovation and marketing to compete with the stores brands’ cheaper, high quality.